Diffrent Types of Charts

The three most popular types of charts in Forex trading are line charts, bar charts, and candlestick charts. Each chart type offers a different perspective on the market which helps you with your technical analysis, strategies, and making informed decisions quickly.

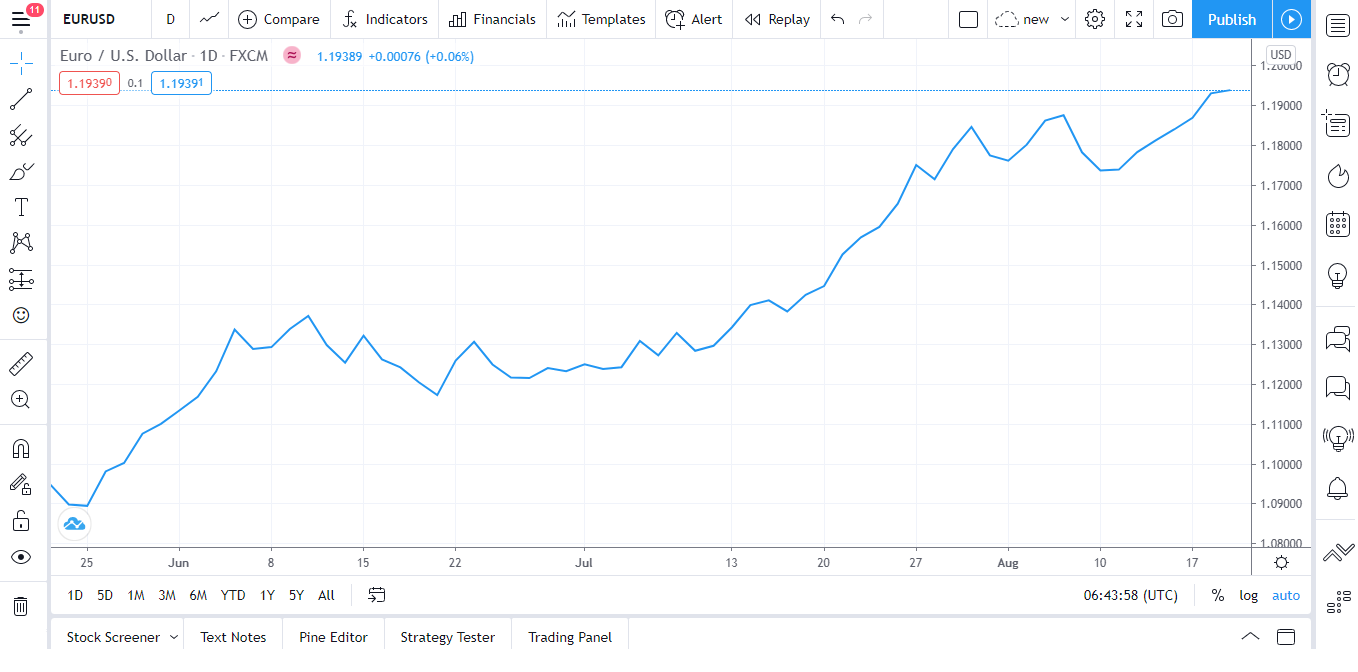

Line Charts

A line chart is the simplest type of chart as it represents only the closing price on each day over a set period of time. The price action on a line chart is represented by a line and prices are displayed along the side. The pros of using a line chart are its simplicity because it provides an uncluttered easy to understand the view of the assets price over a given period of time. The disadvantage associated with using a line chart is the fact that it does not provide visual information of the trading range for the individual points such as the high-low opening and closing prices.

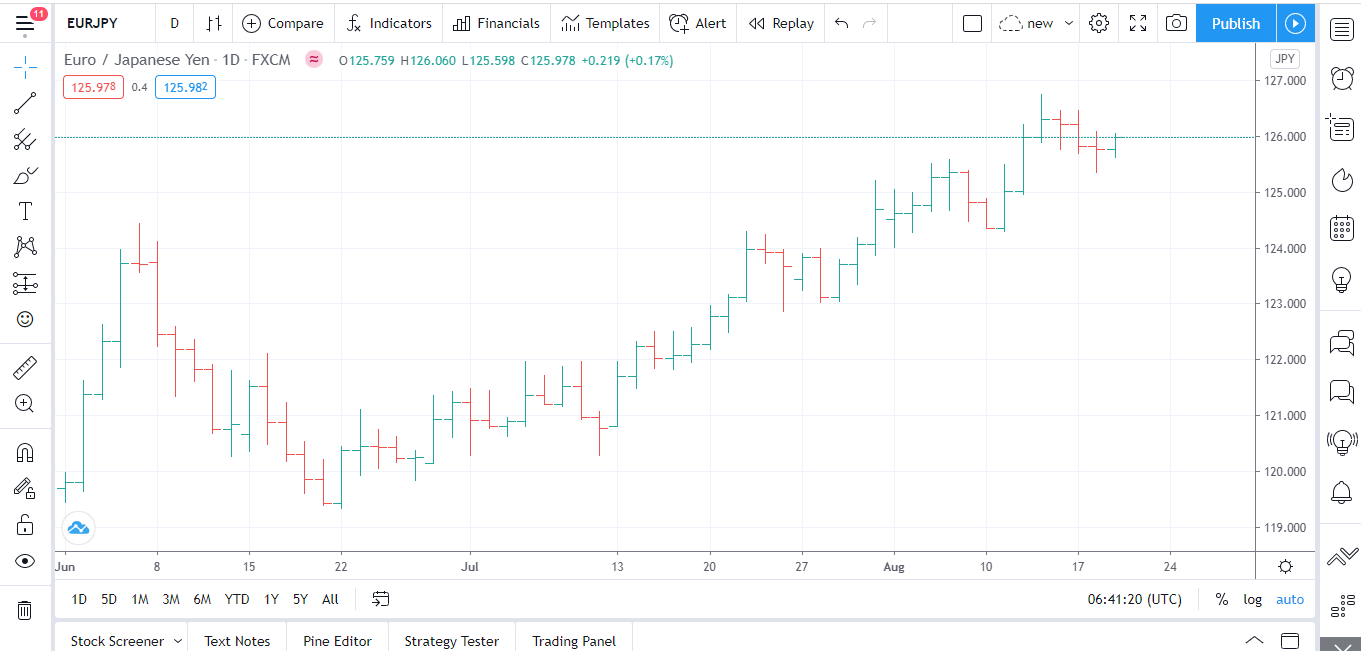

Bar Charts

A bar chart on the other hand displays their opening and closing prices as well as the highs and lows for the trading period. If you look at the bar chart you can see that the vertical bar represents the high and low for the trading period. The top of the bar represents the highest price and the bottom of the bar represents the lowest price. The close and open prices are represented on the vertical line by a horizontal dash. Opening prices are shown by a dash on the left side of the bar conversely the close is represented by the dash on the right-hand side. Now a bar that has colored red signals that the price has gone down in that period. Likewise, a bar that has colored green signals that the price has gone up in that period.

Candle Sticks

Finally, we have the candlestick charts, candlestick charts actually show exactly the same price information as a bar chart just in a visually different way. Candlestick bars still indicate the high to the low range with a vertical line however larger block in the middle known as the body that indicates the range between the opening and the closing prices. The wick of the candlestick shows the day’s full range which is the high and low traditionally.

If the body in the middle is filled with red or sometimes black then the price closed lower than it opened. A green or sometimes white body means the closing price is higher than the opening price. In other words, a long green real body visually displays the bulls are in charge while a long red real body signifies the bears are in control of the session. Each candlestick represents one period, for example, a day an hour a minute or depending on the timeframe you have set.